2022

Resale Report

Foreword

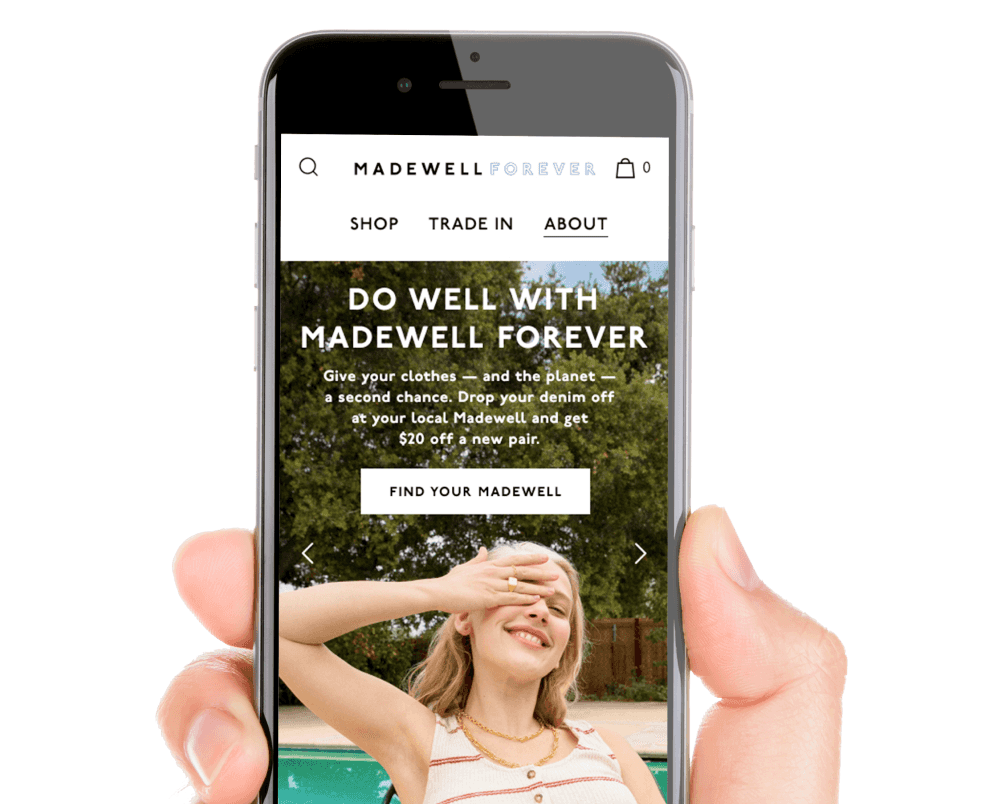

At thredUP, we’ve spent the past decade studying resale. While the last 10 years were dominated by marketplaces, brands and retailers are driving the next wave of secondhand. In fact, brands with their own resale shops increased 275%, from 8 in 2020 to 30 in 2021. We are still in the very beginning of this trend, but the acceleration of resale adoption is a positive signal with enormous benefits for the planet. We’re proud to share this year’s Resale Report, proving that with the collective power of conscious consumers, resale marketplaces, and forward-thinking brands and retailers, we can pioneer a more sustainable future for the fashion industry. There is still much work to do. We hope you join us on this mission.

– James Reinhart, thredUP Co-Founder & CEO

Size & Impact of Resale

Secondhand Is Becoming a Global Phenomenon, Expected To Grow 127% by 2026

The global secondhand apparel market will grow 3X faster than the global apparel market overall.

North America Leads Global Secondhand Apparel Market Growth

U.S. Secondhand Market Is Expected To More Than Double by 2026, Reaching $82 Billion

Secondhand saw record growth in 2021 at 32%.

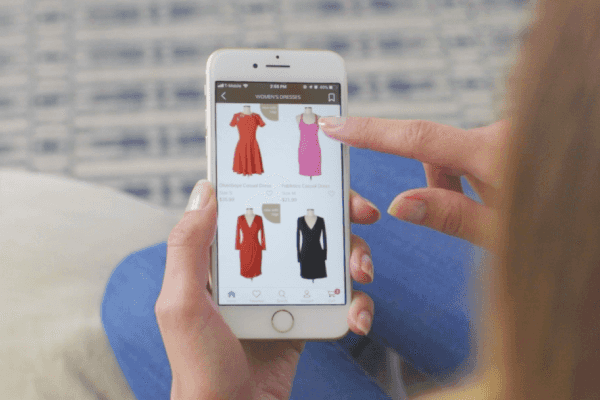

Technology and Online Marketplaces Are Driving the Growth of the U.S. Secondhand Market

Online resale is the fastest-growing sector of

secondhand and is expected to grow nearly 4X by 2026.

U.S. Secondhand Market Sees More Sellers Than Ever

The Clean Out trend accelerated during the pandemic and has real staying power.

U.S. Consumers Are Embracing Secondhand in Droves

In 2021, 244 million consumers say they have or

are open to shopping secondhand products.

Resale Is a Powerful Solution to the Fashion Industry’s Wastefulness

Demand-side management and better resource efficiency are critical if we are to meet our 2050 carbon targets (IPPC). Not only can more circular business practices cut emissions, reduce primary resource use, minimise waste, and create a more accessible economy for all, but

The growth of circular systems shows many recognise this can be a winning business formula, too.

Susan Harris, Technical Director, Anthesis Group

secondhand is transforming closets

Secondhand Is Stealing More Share of Closet Than All Other Growth Channels Combined

Secondhand is expected to grow by 9 points, more than any other sector.

Secondhand Is Holding On to More Shoppers Than Any Other Category

81% of first-time thrifters plan to spend the same amount or more on secondhand in the next 5 years.2

Where shoppers plan to spend more or less money in the next 5 years2

Consumers Are Thinking Secondhand First

Secondhand Fashion Is Seen As More Accessible and Inclusive Than Sustainable Fashion

4X as many consumers say they shop secondhand fashion than they do sustainable fashion.2

The Closet of the Future Is Circular With an Ever-Rotating Wardrobe

More than half of consumers have both bought and sold secondhand apparel.2

Top Categories To Buy Secondhand

Plus, the most popular item in each category on thredUP.

Casualwear

Outerwear

Accessories

Footwear

Loungewear

Sportswear

Workwear

Childrenswear

Occasionwear

I’ve witnessed a seismic shift among my fashion industry peers in the past several years; gone are the days when we promoted new items to consumers every season.

Closets today are filled with secondhand as we’ve collectively embraced a more circular mindset and learned to do more with less.

Building a closet of “the ones that got away” is so much more unique and rewarding than shopping for new arrivals—it’s a win for your wardrobe and for the planet.

Julia Gall, Fashion Stylist and Writer

Inflation’s Impact on the Consumer

Consumers Are Spending Less on Apparel As They Feel the Squeeze of Inflation

The top 5 categories where consumers are noticing price increases:4

Consumers are responding to inflation by cutting back spend on apparel.

Secondhand Is a Bright Spot, Helping Consumers Stretch Their Dollar Further

58% of consumers say secondhand has helped them in some way during a time of inflation.4

Top Reasons Consumers Say Secondhand Has Helped4

who’s thrifting & why

Consumers Who Shop Secondhand Identify As Thrifters

Consumers Choose Secondhand To Save Money While Leveling Up Their Wardrobes

Top 3 Reasons Consumers Buy Secondhand Over New

Gen Z’s Motivators to Buy Used

For Some Consumers, Purchasing Behavior Is at Odds With Values

Social Pressure Fuels Consumers’ Addiction to Disposable Fashion

Most Shoppers Aspire To Buy More Secondhand and Want To Quit Fast Fashion

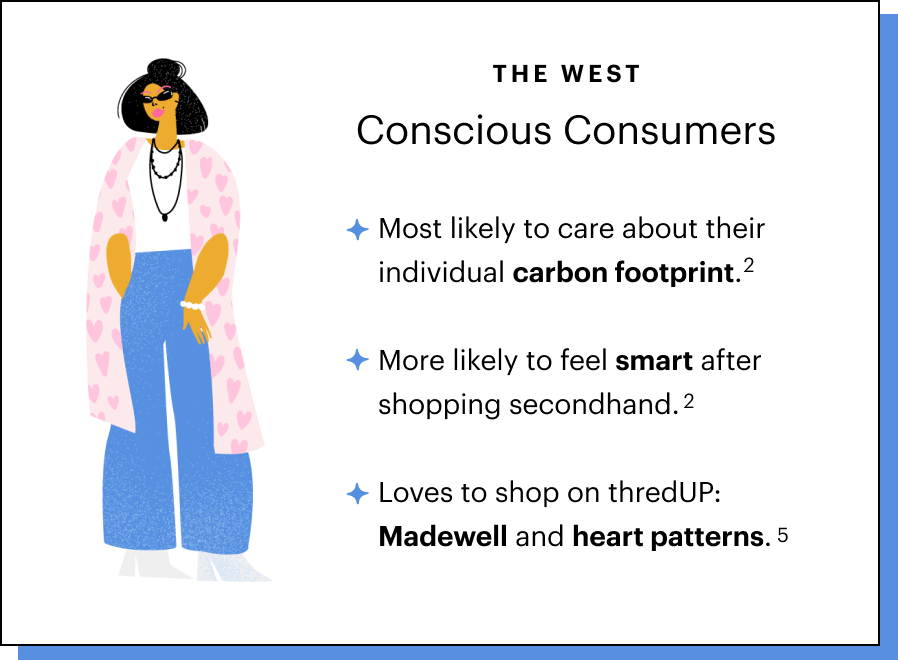

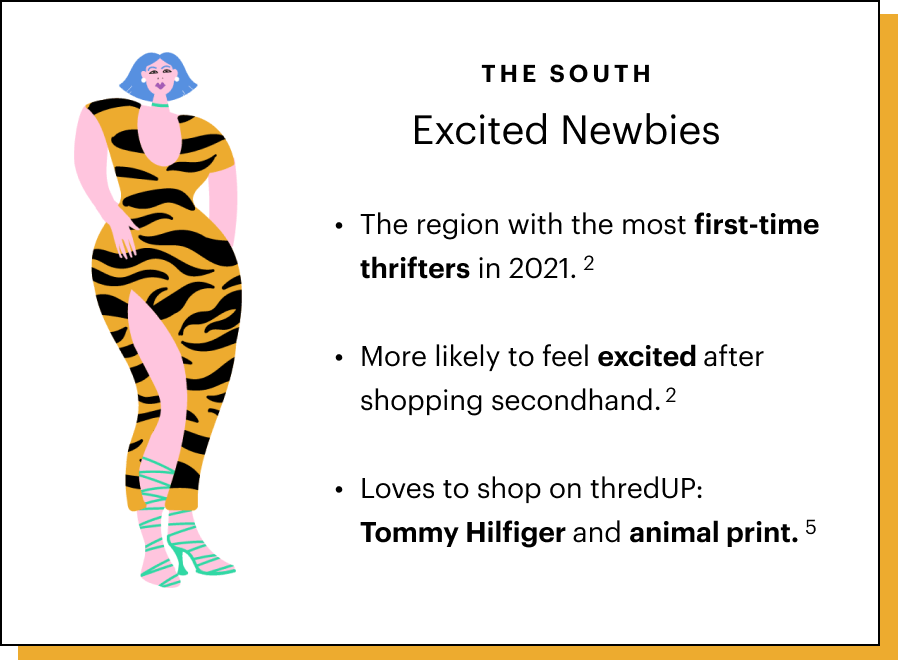

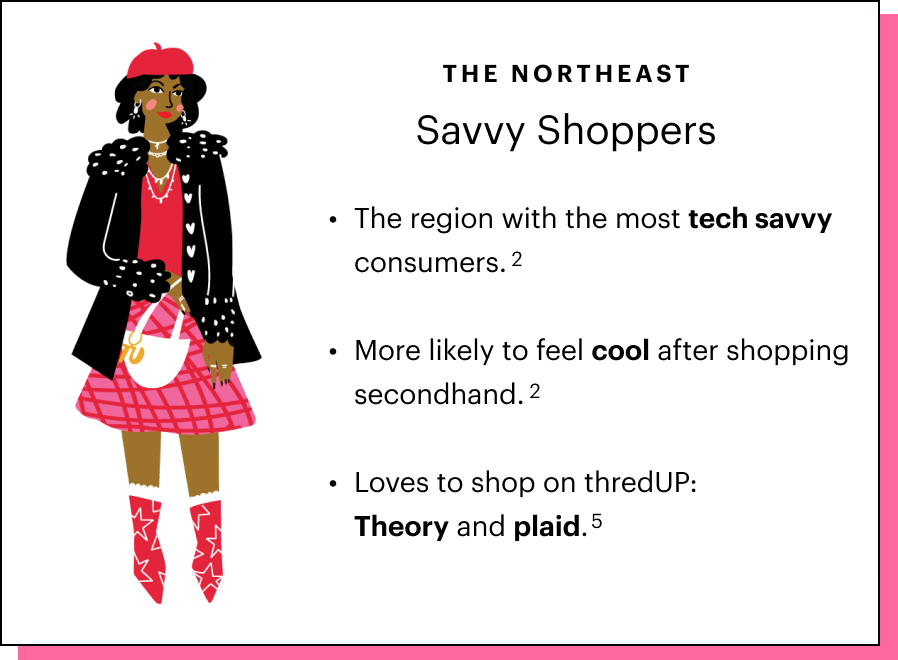

Thrifting Evokes Positive Emotions and a Sense of Pride*

Thrift Across the Nation: How the States Stack Up

At the rate in which the fashion industry is producing clothing, it is crucial that resale becomes a key part of citizens’ lifestyles.

The choice to embrace reuse is not always easy when we are faced with endless options—many of which encourage the purchasing of cheap, disposable fashion— but the rise of online resale is enabling citizens to make different choices and do so with pride and joy.

Aja Barber, Author of Consumed: the Need for Collective Change: Colonialism, Climate Change & Consumerism

Future of Retail

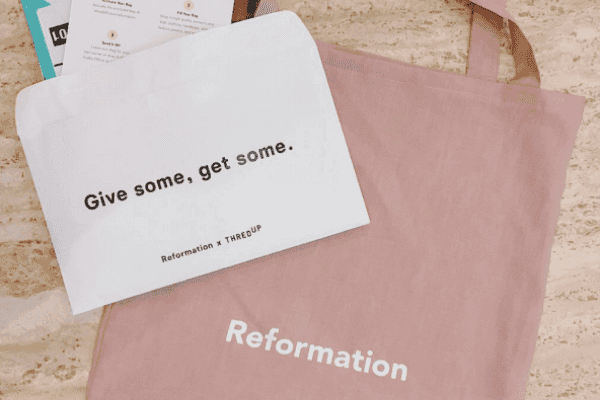

The Rise of Recommerce: Brands and Retailers Want In

Retailers Are Embracing Resale To Satisfy Consumer Demand

Resale Is an Inevitable Part of Retail’s Future

More than half of retail executives without resale programs say they feel behind the curve relative to their peers.3

Retailers Get Into Resale for Sustainability, but Stay to Drive Revenue

Top 3 Reasons Retail Execs Want to Get Into Resale3

The #1 Benefit for Retail Execs that Already Have Resale Progams3

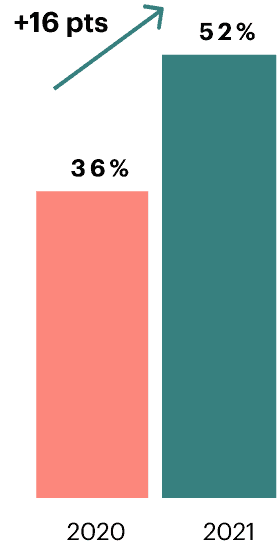

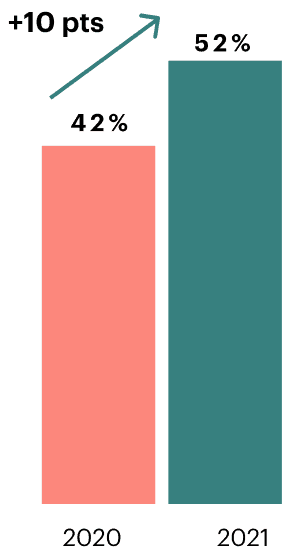

Positive Resale Sentiment Is Increasing Among Retail Executives

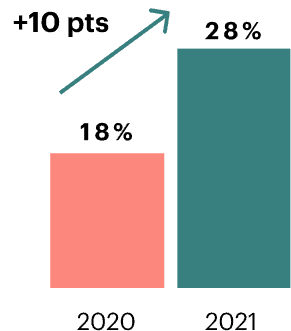

The Barriers for Retailers Entering the Resale Ecosystem Are Being Lowered

Resale Is Becoming a Strategic Priority for Retailers

Resale is becoming increasingly mainstream as consumers seek out value options, both in terms of price and sustainability. Retailers and brands have a significant opportunity to use resale models to acquire younger and price-conscious shoppers, increase customer loyalty, and drive revenue—all while doing good for the environment.

Resale is the future of retail, and it will be interesting to see which innovative businesses capitalize on this opportunity.

Ken Fenyo, President, Research & Advisory, Coresight Research

A decade in resale

More than a decade later, thredUP’s platform is enabling millions of consumers to buy and sell secondhand clothes at scale and is pioneering a movement for brands and retailers to embrace a more sustainable future for fashion.

Then & Now

Market Growth: 2012-20211

thredUP Growth5

Resale Industry Milestones

Methodology

thredUP’s Annual Resale Report contains research and data from GlobalData, a third-party retail analytics firm. GlobalData’s assessment of the secondhand market is determined through consumer surveys, retailer tracking, official public data, data sharing, store observation, and secondary sources. These inputs are used by analysts to model and calculate market sizes, channel sizes, and market shares. Further, for the purpose of this report, GlobalData conducted a January 2022 survey of 3,500 American adults over 18, asking specific questions about their behaviors and preferences for secondhand. GlobalData also surveyed the top 50 U.S. fashion retailers and brands in January and February 2022 to gather their opinions on resale. In addition, thredUP’s Resale Report leverages data from the following sources: Green Story Inc. research and internal thredUP customer and brand performance data.

Disclosure: All third-party brand names and logos appearing in this report are trademarks or registered trademarks of their respective holders. Any such appearance does not imply any affiliation with or endorsement of thredUP. Published: May 2022.

Primary Sources

1. GlobalData Market Sizing: GlobalData’s assessment of the secondhand market is determined through ongoing retailer tracking, official public data, data sharing, store observation, consumer surveys, and secondary sources. These inputs are used by analysts to model and calculate market sizes, channel sizes, and market shares. Market data analysis included in this report was done in February 2022.

2. GlobalData Consumer Resale Survey: The consumer data in this report is derived from a consumer survey of 3,500 U.S. adults. The survey asked them a number of questions about their attitudes towards apparel, secondhand products, and resale products. The sample was designed to be representative of age and income and was also geographically representative. Surveying was undertaken by GlobalData in January 2022. Note: Survey data only sampled U.S. women until 2020.

3. GlobalData Fashion Retailer Survey: 50 U.S. fashion (apparel, accessories, footwear) retailers were surveyed in January 2022 about their Circular Fashion goals.

Secondary Sources

4. GlobalData Consumer Pulse Survey: The consumer data in this report is derived from a consumer survey of 2,000 U.S. adults. The survey asked them a number of questions about the impact of inflation towards general goods and services, apparel and resale products. The sample was designed to be representative of age and income and was also geographically representative. Surveying was undertaken by GlobalData in April 2022.

5. Internal thredUP Customer / Behavior Data

6. thredUP corrected this stat from 42% to 59% on 6/22/22

Retail Sector Definitions

Secondhand: Consumption of all used apparel. Includes both the Resale sector and the Thrift & Donation sector.

Donation & Thrift: A sector of the broader ‘secondhand’ market that includes traditional options such as Goodwill, Salvation Army, and yard sales. These secondhand options are primarily, but not exclusively, offline.

Resale: A sector of the broader ‘secondhand’ market that includes more curated product assortments, often well merchandised and/or higher end. Examples include thredUP and TheRealReal as well as upscale offline players like Buffalo Exchange. These secondhand options are primarily, but not exclusively, online.

Secondhand Products: Consumption of all used apparel, footwear, accessories, books, furniture, entertainment, and beauty.

Department Stores: A type of general retail store, wherein the retailer displays products within distinct departments, often located on separate floors, specializing in defined product areas. Examples include Bloomingdale’s, Macy’s, JCPenney, Nordstrom.

Off-Price: A retailer that sells items at lower prices than those typically charged by retail businesses. Off-price stores typically purchase overstocked goods or make special purchases. Examples include TJ Maxx, Marshalls, Ross, Burlington Coat Factory.

Value Chains: Value stores are a retail format that sells inexpensive items, at a single or limited number of price points. Examples include Walmart, Target, Dollar Tree.

Mid-Priced Specialty: Specialist clothing retailers operating in the middle of the market in terms of price. Not value but not premium or luxury. They tend to be found in malls or traditional main street locations. Examples include Gap, Ann Taylor, J. Crew.

Fast Fashion: Specialist clothing retailers with a fast stock turnaround and whose business models rely on selling high volumes at (usually) inexpensive price points. Examples include Zara, H&M, Forever 21.

Direct-to-Consumer: Specialists and generalists selling clothing directly to the public. Primarily online only. Excludes C2C or auction type sites, and the online side of traditional retail businesses. Examples include Everlane, Warby Parker, Outdoor Voices.

Sustainable Fashion: Apparel that has been produced, sold, and distributed in such a way as to minimize, as much as possible, any damaging social and environmental impact. To be classified as sustainable, a company must reduce negative impacts at multiple stages of the supply chain and of the product’s lifecycle. Examples include Reformation, Allbirds, Eileen Fisher, Patagonia.

Amazon: Amazon’s clothing sales in the U.S., stated at gross merchandise value.

Subscription: Subscription-based services for clothing. Excludes non-clothing elements of subscription models, and rental services. Examples include StitchFix and Trunk Club.

Other: Sales of clothing from all other sources, including grocers and supermarkets, drug stores, duty-free, warehouse clubs, variety stores, other non-clothing specialists, and convenience stores.